Overview LC 1 Private Placement – 12,8 % p.a. tax deducted

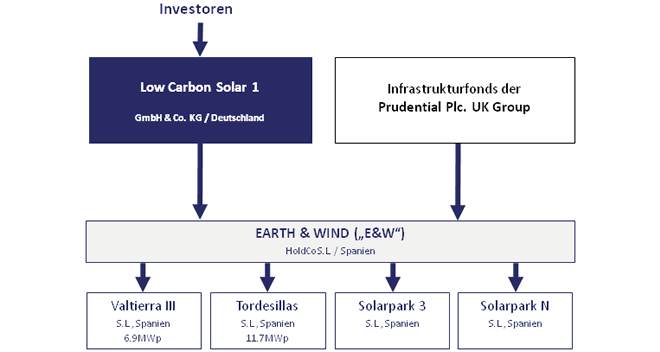

Investment in solar parks is an ideal form of equity investment. Solar Partner offers the exclusive opportunity to invest as co-investor with Prudential Plc, one of the world’s largest insurance companies and investment funds to invest in existing and grid connected solar parks. The parks in question have already been constructed and connected, and are generating daily electricity. They all have long-term external financing through banks. The facilities have been built by recognized international companies, using exclusively high quality components. The combination of these factors eliminates the typical investment risks, which represent investing in other funds structures such as Blind Pools. The investor, with his private capital contribution becomes shareholder of the holding company Low Carbon Solar 1 Spanien GmbH & Co. KG.

Acquisition of already optioned solar parks in Spain

By the increment of the private equity are acquired the existing optioned solar parks in pipeline. The existing installations have been recently ratified in their rates, by the new released Royal Decree of Law 1565/2010, from the Spanish Government on 19 November 2010, which specifies the subsidiary rates for solar energy. This means that investors have guaranteed, by law, their inversion as co-owners in existing grid connected solar parks over the next 25 years.

Key Data:

| Overall investment: | approx.100.000.000 Euro | |

| External financing: | 75.000.000 Euro through large Spanish banks | |

| Capital contribution: | 25.000.000 Euro | |

| Minimum participation: | 200.000 Euro plus 2% Agio | |

| Return per year: | average 15,9% per year, from 12%, up to 37,9% after tax with progressive participation. | |

| Liquidy reflow: | 382% plus proportional in the residual value |

|

| Investment period: | up to 24 years | |

| Subscription: | up to 31.12.2011 – premature closure if the capital contribution is reached | |

| Cancellation: | From the 5th year on the investor has the right, under certain circumstances to return the participation at nominal value, discounting obtained dividends |

Investment example:

| Overall investment: | 200.000 € | 500.000 € | 1.000.000 € | |||

| Duration | 24 years | 24 years | 24 years | |||

| ∅ Return per year in € | 31.810 € | 79.527 € | 159.054 € | |||

| Liquidy reflow in € | 763.460 € | 1.908.650 € | 3.817.300 € | |||

| ∅ Return per year in % | 15,9% | 15,9% | 15,9% | |||

| Liquidy reflow in % | 382% | 382% | 382% |

Important: The investors participate in equal relation as the initiating share holders of the companies.

No risks of investing in a completed solar park in Spain

Investment of share holder capital:

in solar parks which are connected to grid and producing energy under the attractive advantage of feed in tariffs subject to deflation adjustments. Development risks, construction and commissioning are therefore avoided.

Capital increase contribution:

€ 25 Mio. (Equity); designated to the acquisition of grid connected solar parks in value of € 100 Mio. (Incl. external capital)

The data and numbers given are calculated values. The final calculation are published in the participation portfolio, which you may request filling out our contact form.

Investment participation

The possibility of participation in the German company Solar 1 Low Carbon Spanien GmbH & Co. KG entails participation in grid connected solar parks in Spain, which are property of Earth Wind and Renewable Energy SL, respectively and in its pipeline of projects. Members of Prudential Plc and the holding company Solar 1 Low Carbon Spanien GmbH & Co. KG offer an exclusive circle of qualified investors the possibility to acquire shares in the company Earth & Wind in the form of a capital increase.

This investment opportunity allows to a small, selected group of people -either physical or legal nature- investment in the form of shares of 200,000 Euro minimum. With this investment, the investor acquires co-ownership of the Earth and Wind Renewable Energy Ltd. in its solar parks owned with 18.6 MWp and the acquisition of further solar parks contained in their project pipeline.

| Actual parks in hold of Earth & Wind: | Solar parks with a capacity of 18,6 MWp |

| Company value Earth & Wind actual: | 99.000.000 EUR, with 28.400.000 EUR equity and 71.500.000 EUR external finance capital |

The investment proposal is submitted to the buyout of the limited partner’s capital in Solar 1 Low Carbon Spanien GmbH & Co. KG with a capital of 25 Mio. Euro. The subscription is possible from immediate on, until closure if the capital contribution is reached. The participation portfolio contains detailed conditions, contracts and subscription certificate.

Private Placement for private investors

Current partners Prudential Plc and Low Carbon 1 Solar Spanien GmbH & Co KG offer an exclusive circle of investors the possibility of acquisition of shares in the Earth and Wind Renewable Energy Ltd. in form of a capital increase.

Interested investors should be in possession of substantial liquidity exceeding the minimal investment participation amount of 200.000 Euro.

Since this specific investment opportunity is a long term capital inversion, the interested parties should not be scheduling their assets for other purpose during its term. However, it is possible under certain circumstances to liquidate the participation prematurely.

Fiscal conditions for investors have been considered under aspects of taxation in Germany. Please consult your financial advisor to this regard.

Further information including definite calculations at long term investment and returns, as well as the companies contracts are at your disposition. Please contact us.

Guarantee for the power production is the Sun.

Spain stands by the highest solar irradiance values in Europe.

These differ according to location and situation in the country, but in any case are distinguished by its leading position in European comparisons. Through the adjustment of the deflation rates (PCI) for current feed in tariff rates along all the time of the energy production, the benefits of solar energy are guaranteed high level in Spain.

Investment in Spanish solar parks is highly profitable:

Atractive and gauranteed feed in tariffs:

For parks connected to grid under the legislation of Royal Decree 661/2007 and 1578/2008 it is guaranteed an attractive feed in tariff, applicable to all grid connected plants in, and from October 2008 on, and valid for 25 years.

Attractive prices to buy solar parks:

Increasing growing pressure on companies to sell their solar parks; speculative companies that have developed solar plants without being PV their regular activity (eg developers) and now willing to sell the solar parks. High production stability: Unlike wind energy the sun offers continuous production values, varying annually in just a + / – 3%.

Ease at external financing:

Thanks to the high reliability of the solar park energy production, financial institutions are giving capital available to finance up to 80%.

No Blind Pool, you are investing only in existing solar parks:

Unlike inversion in regular solar investment funds, which invest their capital after closing of the participation capital and therefore need to consider the costs for development and planning, financing and construction risks, in our case you are only investing in grid connected parks. The initiators of the project are leading companies that operate globally and select the parks under very predetermined criteria to be included in the project pipeline.

Criteria at selection of the solar parks:

1. Emplacement with high global radiation values

– Situations with a superior global radiation value than 1.600 kWh/kWp (in comparison: Germany (south Baviera) approx. 1000 kWh/kWp)

– All solar parks are in different locations (risk diversifying)

– Focused on smaller installations, all grid connected

2. High level technical components and regular maintanence

– Only solar plants under use of high level technical components and bankable modules are considered

– Inverters: eg SMA, under consideration of reserves

– Periodical replacement of modules and panels in case of productivity degradation

3.Professional maintanence of the installations

– all plants are supervised by our own company based in Spain

– Permanent cooperation with companies with extense know how and experience in the solar industry and technical maintenance.

– Regular maintenance and monitoring

The selected connected parks pass an exhaustive selectivity process based on performance criteria, technical components, financial viability, taxes and financing through renowned advisory institutes such as among others, Deloitte, Garrigues and Uria Menéndez.

Investor representation: The investor company is represented on the Executive Board of Earth Wind and Renewable Energy Ltd. by a representative of their own, in order to safeguard the interests and rights of the investors.